Budget Reads

How does the Singapore Government manage the national Budget to ensure that Singapore’s current and future needs are addressed, while remaining fiscally sustainable?

In this section, you can read the below articles to learn about the measures and initiatives that the Singapore Government introduced in past Budgets.

The Challenges In State Spending

How To Spend Billions Of Dollars To Take Care Of Millions Of People

Ever wondered how the Government manages Singapore’s income and expenses?

Just like a family has to decide how to use its income to meet different needs, the Government manages the nation’s funds to ensure there is enough to go round for everyone today, with some left for a rainy day, and a portion invested for the future.

State spending is financed by government revenue, which comes from sources like taxes, fees and charges, statutory boards’ contributions, and the Net Investment Returns Contribution. Ensuring that our economy can continue to grow sustainably in order to provide steady revenue, as well as deciding how best to allocate the money each year, are no easy tasks.

Ahead of each year’s Budget are months of intense planning and discussion. At the heart of the big decisions are many questions on national priorities to think through.

Where Are The Needs Today?

Defence, education, the economy, healthcare… a country has different needs to meet and different segments of the society to take care of, from the very young to the not-so-young.

Do we support businesses with more grants or more tax breaks to encourage innovation? Distribute more GST vouchers or give higher workfare income supplement?

The more we spend on one area, the less we have for another, if our income remains constant. There will always be trade-offs to be made.

Immediate Needs Or Long-Term Goals?

A family may need to choose between buying a car for use today and saving up for their children’s education tomorrow. Similarly, a country needs to weigh the considerations for these competing needs.

Spending more on immediate needs means having less to save and invest for future years.

Singaporeans today benefit from the contributions made by earlier generations. We have a strong education system, a pro-business environment, high-technology public infrastructure, and a clean and green living environment.

For the country to remain secure, competitive, and cohesive, we need to plan and put aside money for long-term goals, while providing for current needs.

This will be fair to future generations of Singaporeans, who may otherwise have to bear the burden if we consume all the benefits now.

How To Spend Within Our Means

Whether it is spending on today’s needs or future goals, how much we can spend depends on how much we earn.

If we spend more than what we earn endlessly, we will need to borrow from others and will be in debt. A part of our future earnings will then go towards paying interest, leaving less to spend on other areas. This is not a desirable situation to get into.

Alternatively, we can try to earn more. Indeed, Singapore’s revenue has been increasing over the years, along with steady economic growth.

However, spending has caught up even faster, as more support is channelled to the elderly, lower income families, and healthcare needs. So, the country must weigh our expenses carefully to keep a balance between income and expenditure.

Being Prudent Now So That We Have Enough To Spend In Future

With careful planning and use of public money, resources can go where they are needed, reach the people who need help and bring us closer to long-term national goals.

This is why each year, we pore over the plans and allocate our resources with great care.

In deciding how to use the billions of dollars in our Budget to cater to the millions of Singaporeans on this island, we are paving the way to secure the future of Singapore.

Moving Ahead Together! How Singapore's Budgets Drive Economic Growth

Here’s a lookback at economic measures in past Budgets and how to ready yourself for the future

The Government Budget presented each year is not simply a plan to spend.

Behind the dollars and cents is a strategic plan to get Singapore to where we want to be in the future.

The Future Was Always Present in Past Budgets

Securing Singapore’s future is a recurrent theme in each Budget, even when we had to tackle more immediate challenges, especially during economic downturns.

When the global financial crisis hit Singapore in 2008, a Resilience Package was swiftly rolled out in the 2009 Budget to save jobs and help businesses stay afloat. We took the opportunity to retrain workers, invest in infrastructure, and encourage companies to innovate and remain competitive. Being forward-looking enabled Singapore to recover faster and emerge even stronger.

Each Budget provides an opportunity to review our economic measures and introduce new ones to grow the economy. Over the past decade, we made two major shifts in our economic agenda.

From Economic Restructuring to Industry Transformation

Productivity: The Next Driver of Economic Growth

As a small economy deeply plugged into the global market, Singapore has to remain nimble to changes.

Around the world, multinational companies are moving their operations to where conditions favour them. With digital technology and advanced logistics, local businesses find themselves even competing with international players without a presence in Singapore.

Given falling birth rates and an ageing population, our workforce is growing at a slower rate. At the same time, we do not want to be over-reliant on foreign labour.

Therefore, there is an acute need productive for the economy to remain competitive.

Singapore’s aim is to develop into an advanced economy driven by higher skills, productivity and innovation. Only then can the economy continue to grow and translate into higher incomes for Singaporeans in future.

2010 to 2015: Economic Restructuring

After the global financial crisis, the country embarked on a phase of economic restructuring to raise skills and productivity.

An Economic Strategies Committee (ESC) was set up to develop strategies for Singapore to maximize opportunities in a new world environment, and to achieve sustained and inclusive growth.

A central recommendation made by ESC was for the Government to provide strong support to the people by investing in education and training, so that individuals could upgrade their skills, capabilities and expertise, and move up the career ladder.

Another recommendation was to deepen firm capabilities to seize opportunities in Asia and to facilitate local firms to grow into industry leaders in Asia.

Through Budgets 2010 to 2015, the framework for economic restructuring was implemented with initiatives such as the National Productivity Fund, and the introduction or enhancement of comprehensive programmes, including the Workfare Training Scheme, Internationalisation Finance Scheme and Double Tax Deduction for Internationalisation Scheme.

From 2016: Industry Transformation

In 2016, the broad-based economic restructuring agenda was sharpened and deepened, as Singapore moved onto the next phase of industry transformation.

The performance and challenges faced by different industries were uneven. Some had to overcome cyclical weaknesses while others were tackling structural shifts.

A broad Industry Transformation Programme was launched with a more targeted and sector-focused approach to help enterprises and industries move up the value chain through strategies such as innovation, internationalization, and deep capability development.

With differentiated roadmaps for the major industry sectors, the Industry Transformation Maps pull together existing restructuring efforts, fosters partnerships, encourages the use of technology, while supporting local enterprises to internationalise.

Beyond Basic Education to Continuing Education and Lifelong Learning

People: Our Most Valuable Resources

As industries transform, can the people match up to the new jobs and new skills required?

We have always invested heavily in education. Over the years, we built and upgraded schools, employed higher qualified teachers, and expanded our universities, polytechnics, and ITEs.

2008: Continuing Education and Training Masterplan

The old mantra of “study hard and find a good job” is inadequate. In an era of disruption, continual learning and training is necessary. We may need to learn new skills, retooling ourselves, and perhaps even enter new and emergent fields.

Recognising this, recent Budgets have progressively given more support for continuing education and training (CET) and more resources to train workers. Between 2008 and 2014, $2.4 billion was added to the Lifelong Learning Endowment Fund to support CET. In 2010, the Workfare Training Scheme was introduced to encourage older workers to upgrade their skills.

2015: SkillsFuture: Lifelong Learning for All

In the 2015 Budget, we took further steps and embarked on the next wave of investment in our people with SkillsFuture.

SkillsFuture signals to Singaporeans the importance of learning at every age of life and provides the opportunities to further ourselves to the fullest potential throughout life, regardless of starting points. For the country, it will develop deep skills and mastery in our workforce to take our economy to the next level.

Under this initiative, Singaporeans can access a range of programmes, tools, and support such as MySkillsFuture – an education, training and career guidance online portal, the SkillsFuture Study Awards, and the SkillsFuture Credit to deepen or widen their skills, so that everyone can learn continuously to stay relevant.

Staying Nimble and Ahead

Transforming our industries and strengthening the capabilities of our people are two important strategies to fuel future economic growth in Singapore.

With our sights set on long-term goals, each Budget provides resources to grow the economy, so that the country is in a better position to provide good jobs, better incomes, and a higher quality of life for all Singaporeans, even amidst an era of change.

Injecting More Into Singapore's Healthcare As We Age

The greatest wealth is health

Singapore already achieves good outcomes in healthcare, with a system that is cost-effective, while providing good care. But the Government is also spending an ever larger percentage of its income on healthcare. And this is inevitable, as the population ages. By 2030, 1 in 4 Singaporeans are expected to be over 65.

While some may be concerned at a rising national healthcare bill, it remains necessary, and the Government will ensure that healthcare services continue to remain accessible and affordable for everyone, through the provision of more healthcare facilities and regular reviews of our social safety nets.

How we spend $10,700,000,000?

In the Financial Year 2017, the Government allocated $10.7 billion to healthcare – the third largest spending by ministry, behind education and defence. This comes to about 2.5% of GDP.

The amount is expected to “rise quite sharply” in the next three to five years as our population ages, Finance Minister Heng Swee Keat has said. He expects it to go up by at least $3 billion by 2020 from current levels.

A jump of another $3 billion by 2020 would mean that in 10 years, the health budget could climb to more than three times its 2010 level, when it was $4 billion.

Here’s a look at what the Government has been spending on.

Infrastructure

At least one new hospital every two years.

That’s the rate at which a healthcare facility will pop up in the coming years.

In 2018, Sengkang General and Community Hospitals will open and offer a total of 1,400 beds.

In 2020, Outram Community Hospital, situated near the Singapore General Hospital, is scheduled to be completed and will add 550 beds.

In 2022, the 1,800-bed Woodlands Health Campus will open and have an acute hospital and a community hospital sharing the same building. So will the Integrated Care Hub, a 500-bed community hospital, situated next to Tan Tock Seng Hospital.

This comes on top of the five new hospitals – Khoo Teck Puat Hospital, Ng Teng Fong General Hospital, Yishun and Jurong Community Hospitals, and the CGH-SACH Integrated Building – that have been opened since 2010.

These new hospitals are part of a multi-fold plan to prepare for the expected surge in demand from a rapidly ageing population, while also easing any bed crunch.

After all, an elderly person is three to four times more likely to be admitted to hospital compared to a younger person – and once admitted, they stay for twice as long.

In 2018, the share of Singapore’s elderly population who are 65 and over will match the number of young who are under 15 for the first time.

Manpower

In tandem with the infrastructure boost, an additional 30,000 healthcare workers will be needed between 2015 and 2020 to cope with the increased demand for healthcare services.

Over the next three years, the Health Ministry is investing $24 million to get those making a mid-career switch on board. The funds will go to various schemes – from new overseas graduate scholarship for those who do not have nursing degrees but want to join the sector, to nursing professional conversion programmes – to help more Singaporeans take up healthcare jobs.

Technology

While improving the healthcare hardware, the Government is also investing in the software to improve quality of care.

For instance, close to 600 bed transporters will be rolled out in four public hospitals from June 2018. The technology reduces the number of people needed to move a bed with a patient on it from two persons to one, improving overall productivity.

The Woodlands Health Campus, when completed in 2022, will provide every patient with an electronic device akin to a watch, which monitors vital signs, activity, and location. It will alert nurses when a patient’s blood pressure goes up by too much, or where to locate a dementia patient.

They can also keep tabs on a patient’s condition after he returns home with tele and video conferencing.

Medical Safety Nets

The Government has expanded the healthcare safety net as well to better support lower- and middle-income Singaporeans, especially as many of them have to support both their children and elderly parents.

Two-thirds of households now receive up to 80% subsidy for home and community-based care, such as community hospitals and nursing homes.

More than 1.2 million Singaporeans are also covered under the Community Health Assistance Scheme (CHAS) for outpatient visits.

MediShield Life, which started in 2015, helps Singaporeans pay for their hospital bills and costlier outpatient treatments, such as kidney dialysis, chemotherapy, and radiotherapy. It protects all Singaporeans, regardless of age or health condition, for life.

Close to $4 billion in subsidies will be provided by the Government in the first five years of the scheme to ensure premiums remain affordable for lower- and middle-income households.

The Government also provides periodic top-ups to MediSave, especially for the lower-income and elderly.

In 2017, the Finance Ministry disbursed over $310 million in MediSave top-ups as part of the Pioneer Generation Package and GSTV-MediSave payouts. The top-up amount ranges from $200 to $1,250 per person.

Working hand in hand, these assistance schemes led to around four in five subsidised hospitalisation bills costing less than $100 after MediShield Life, MediSave, and other healthcare benefits.

A Sustainable Increase in Healthcare Expenditure

Healthcare spending will continue to rise as the population ages, and the Government will strive to ensure continued access to quality and affordable healthcare. At the same time, any increase must be sustainable, with an eye on costs, which are ultimately borne by all Singaporeans.

All of us have a part to play in this.

The Government will build more healthcare infrastructure in the community so Singaporeans can receive appropriate care closer to home. Meanwhile, other priority areas such as education, infrastructure and security will need to receive adequate funding as well.

Healthcare institutions will continue to make the most of limited resources, through providing cost-effective treatment and drugs, and leveraging on technology to deliver better care for our patients.

Individuals also have a part to play, too, such as by eating healthily and exercising regularly, monitoring their own health through regular screening, and managing their chronic conditions well.

Refreshing Singapore's Infrastructure For Future Generations

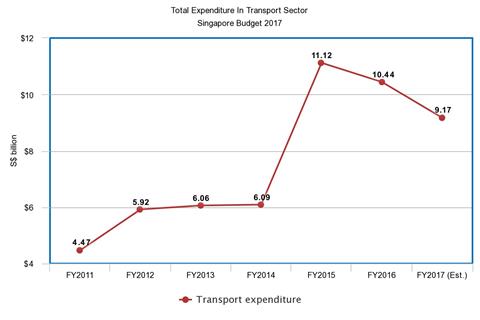

Transportation expenditure has more than doubled over the past few years, as plans to build new airport terminals, construct a new mega port, and improve our public transportation system are underway.

Going places

More than 1 billion passengers, connectivity to 380 cities worldwide, and one flight every 90 seconds.

That’s how far Changi Airport has come since it began operations in 1981. Millions have passed through Changi’s corridors and marvelled at its efficiency, grace, and modern charm.

Changi Airport, voted the world’s best airport for five years in a row, is a Singapore icon and a testament to the economic vibrancy of a tiny island nation-state, which is soaring high despite its size.

But even crown jewels need polishing. Over the years, we have added new terminals to the airport to boost its capacity. In October 2017, Terminal 4 began operations, while retail and lifestyle complex Jewel Changi Airport will open in 2019. Terminal 5 is in the process of being built. When ready, Terminal 5 will allow Changi to handle up to 135 million passengers a year.

Changi Airport is just one of the many investments in infrastructure that Singapore has made over the years. But the improvements are not just cosmetic – they serve to boost our connectivity, which establishes the country as a transport hub for Asia, This, in turn, contributes to our economy and generates thousands of good jobs for Singaporeans.

In 2015, the aviation sector accounted for 3 per cent of Singapore’s gross domestic product and employs over 50,000 workers.

Over the past few years, total expenditure on transportation has more than doubled from $4.47 billion from 2011 to $9.17 billion in 2017.

Mr Lawrence Wong, Minister for National Development and Second Minister for Finance, noted recently that the major infrastructure projects that will unfold over the next 10 years will put the national economy on an even stronger footing.

For instance, the port of Singapore is essential to global maritime trade, with the industry accounting for 7 per cent of the economy. As one of the world’s busiest ports, it handles more than 130,000 vessels annually, carrying goods from Europe to Asia and back.

To ensure that Singapore continues to be at the forefront of maritime trade, we are investing to transform Tuas into a mega sea port. Equipped with the latest technology, such as big data analytics and smart computing, the upgraded ports will position Singapore for the future.

In 2015, the Maritime and Port Authority of Singapore signed a $2.42 billion agreement for works on Tuas Terminal Phase 1, where contractors will dredge the waters, construct the wharves and reclaim 294 hectares of land. It will be completed by 2021. When fully completed in 2040, the new Tuas Terminal will be twice the size of Ang Mo Kio town, and it will be able to handle more than double what the terminal handled in 2016.

Better infrastructure for smoother connectivity within and from Singapore

Apart from improving connectivity to the region and the rest of the world, connectivity within Singapore has also been given a new upgrade.

A S$1.1 billion five-year Bus Service Enhancement Programme, which added 1,000 government-funded buses to the country’s roads, was completed in 2017.

The capacity of 70 per cent of bus services here, or 218 bus services, have been boosted since the programme was rolled out in 2012. This was achieved by deploying more double-decker buses and increasing trip frequencies.

Bus intervals have been shaved from 30 minutes to 15 minutes, thanks to the programme, alongside the transition to the Government’s bus contracting model in 2014 where operators have to meet higher service standards. Intervals for feeder services during peak periods have also been trimmed to six to eight minutes, from more than 10.

The Government also expects to spend more than S$20 billion over the next five years (from 2017) to almost double the train network by 2030, Finance Minister Heng Swee Keat has said.

Major projects include building 30 more MRT stations as part of the Cross Island Line. This enhancement of Singapore’s public transport infrastructure will put eight in 10 households within a 10-minute walk of a rail station.

Work is also underway to improve the performance of the current train services, by replacing the sleepers, third rail, and signalling system of the oldest North-South and East-West Lines.

Trials are underway to test autonomous vehicles in several neighbourhoods. Driverless cars could soon be zipping down the Pan Island Expressway, ferrying families to birthday parties and family reunions.

Meanwhile, we are also further enhancing transport links to Malaysia through better rail connectivity.

The planned 340km-long high-speed rail line, which is estimated to cost S$14.8 billion (RM40 billion) to build, travel time from Jurong East in Singapore to the Malaysian capital of Kuala Lumpur is expected to shorten to as little as 90 minutes, with seven stops in Malaysia.

In addition, both countries inked an agreement in Jan 2018 to build the Rapid Transit System (RTS) Link. Set to open by 31 Dec 2024, the 4km cross-border MRT line would allow commuters to travel seamlessly between Woodlands North and Johor Bahru.

Building homes

Infrastructure development goes beyond building up transport links. We are also investing in major projects, such as the Remaking our Heartland programme to transform towns and districts in Singapore, building new schools and hospitals, and developing regional centres such as Woodlands and Jurong.

These investments are costly but crucial. They serve to boost our economy, create jobs, benefit Singaporean families, and represent the confidence we have in the country’s future.

Meanwhile, national resources are finite, and there needs to be careful and prudent investments to ensure that public funds are spent judiciously, balancing different priorities.

For infrastructure spending, investments are meant for the long-term and targeted at preparing Singapore for the future. Singapore is able to do this because decisions to spend are always guided by the key principle of fiscal sustainability - spending only what the country can afford, while providing for a better future for everyone.

This way, we ensure that future generations of Singaporeans benefit from decisions today.

At the Heart Of Singapore's Budgets

A lookback at social measures through the years

Singapore’s society is changing rapidly. The population is ageing, families are getting smaller, and social needs are growing and becoming more complex.

While many of us enjoy strong family and community bonds, it’s important not to forget those who could benefit from an extra helping hand.

Similarly, the Government will continue to support Singaporean families, assist the needy, and encourage greater community efforts.

Here’s what we’ve been spending on to build an inclusive and caring society, where Singaporeans can improve their lives, where the vulnerable are supported, and where everyone can look to the future with optimism.

Reaching Out to Lower and Middle-Income Families to Keep Up Social Mobility

Our standard of living has been improving steadily. Singaporean households have seen broad-based growth in incomes over the last decade.

While we have been relatively successful in achieving broad-based prosperity so far, managing the issues of income growth, inequality and social mobility is by no means an easy feat.

We want those with less means, as well as their children and family members, to have equal opportunities. In past Budgets, we have introduced or enhanced measures such as Workfare, GST Vouchers, the Silver Support Scheme, housing grants, and education subsidies to help lower-income earners and their families.

For middle-income families who also face challenges, such as the loss of job security, unemployment and rising cost of living, we have strengthened employment support through schemes such the “Adapt and Grow” initiative and SkillsFuture Study Awards, which were enhanced in Budget 2016 and introduced in Budget 2015 respectively. Bursaries for ITE and diploma students, and university undergraduates were also increased in Budgets 2014 and 2017.

A targeted and multi-pronged approach that builds up on earlier Budgets helps our lower-income families aspire towards better a quality of life for themselves. By providing opportunities for individuals to move up in life regardless of where they start from, we can keep up social mobility.

Providing More Support for Our Elderly to Age in Place

By 2030, it is projected that one in four Singaporeans will be 65 years old and above. As the population ages, we have been planning and building infrastructure, rolling out support, and improving workplace policies to help seniors age actively and confidently.

One such measure is the Silver Support Scheme, introduced in Budget 2015. A permanent feature in the national social security system, lower-income seniors at the bottom 20 to 30 percent can receive regular cash payouts to supplement their retirement income.

Meanwhile, those who wish to monetise their HDB flats can make use of the Lease Buy Back Scheme or Silver Housing Bonus, which can provide added retirement income. For seniors who intend to continue working, a Special Employment Credit was enhanced and extended till 2019 to encourage employers to hire older workers.

This set of schemes, as well as other supporting measures, puts in place a positive approach towards ageing and allows seniors to enjoy peace of mind in their later years.

Enabling Those with Disabilities to Lead Independent Lives

Through past Budgets, we have also been building an eco-system of support for Singaporeans with disabilities, as well as their families and caregivers.

Since 2007, three Enabling Masterplans, which are five-year roadmaps to integrate and support those with disabilities, have been implemented to enable Singaporeans with disabilities to develop their potential through education and training, find jobs, and lead independent lives.

The third Enabling Masterplan in 2017 extended more employment support and caregiver support to those with disabilities, on top of existing schemes such as early intervention, tax reliefs and transport subsidies, among others.

Investing in Quality Healthcare Infrastructure to Meet Future Needs

With a rapidly ageing population and an increase in number of people with chronic conditions, we are making huge investments in healthcare infrastructure to ensure our population of accessible and affordable quality healthcare in future.

Two new general hospitals, Khoo Teck Puat Hospital and Ng Teng Fong Hospital, have begun serving the public. At the same time, we are building and upgrading existing general and community hospitals, nursing homes and polyclinics, while increasing the pool of healthcare professionals.

In 2017, $10.7 billion has been allocated to healthcare sector to increase its capacity and ensure that Singaporeans have better access to affordable quality healthcare. This figure is projected to grow from $4 billion to $13 billion by 2020.

Working hand in hand with social measures to improve Singaporeans’ quality of life as a whole, we are also channeling more resources to improve our transport system and living environment.

In Budget 2017, more than S$20 billion is expected to be invested over the next five years. Our train network will almost double by 2030, which will improve Singaporeans’ commute. Neighbourhoods are being transformed under the Remaking our Heartland programme, and heartlands shops are also being rejuvenated under the Revitalisation of Shops package, which was enhanced in Budget 2016 to better support promotional activities and upgrading projects.

Coming Together

Through the annual Budget, funds are allocated to different schemes and programmes, collectively intended to provide stronger support to Singaporean individuals and families. But the needs are many, and as we continue to provide such assistance, we need to continue adhering to the key principle of spending carefully, prudently, and in a targeted manner, so that future generations will not be saddled by any unwise financial decisions that we make today.

At the same time, the building of a strong Singapore society does not come about solely through state action. Each of us has a role to play, whether as individuals, as organisations, or as companies. The Government may facilitate the efforts, but it’s for Singaporeans together to seize the mantle directly in creating a better tomorrow for themselves and for each other.

Supporting Families, Keeping Singapore United

As Singapore undergoes demographic, economic and societal changes, greater demands will be placed on families.

Tackling the increasingly complex challenges will require the Government and the community to stay united, said Finance Minister Heng Swee Keat.

“Individuals, families and the community play an important role in looking out for and supporting one another. We will support individuals and families to better prepare for the future and care for one another,” he said.

“It is this shared responsibility – with individuals, families, community, and the Government all playing their part and supporting one another – that has made our society what it is today, and that will keep our society thriving in the years ahead.”

To this end, Minister Heng announced a range of new and enhanced support measures for families, individuals and students in this year’s Budget.

These include top-ups of up to $200 million for both the Edusave and Financial Assistance Scheme along with a $126 million boost to the Services and Conservancy Charges Rebate which will help to alleviate costs for needy families.

At the heart of these moves is the need to preserve meritocracy and provide equal opportunities for all Singaporeans.

This is particularly crucial when it comes to education, said Minister Heng.

“Education helps our children realise their full potential. We invest heavily in every child, to ensure that everyone, regardless of background, have access to a quality education,” he said.

Starting from January 2019, top-ups to the Edusave fund mean that primary school students will each have their personal accounts increased from $200 to $230 while secondary school students will benefit from an increase of $240 to $290.

He also announced plans to widen the coverage of both the Edusave Merit Bursary and the Independent School Bursary to benefit more families.

The current income eligibility criteria for the Edusave Merit Bursary is S$6,000 in gross monthly household income. From this year onwards, this will be increased to S$6,900.

Similarly, the MOE Financial Assistance Scheme will see its annual bursary quantum for pre-university students increase from $750 to $900.

For 45-year old part-time tutor and mother of three teenage children, Madam Lucy Chan, these additional help could not have come at a better time.

Between her husband who works as a full-time carpenter and herself, the couple have a joint monthly income of $3,500.

Out of this, roughly $2,000 goes towards monthly groceries, conservancy charges and other miscellaneous bills. The rest goes to daily expenses, including paying for their children’s school fees and other expenses.

“All three of my children were covered by the scheme from primary right up to secondary school. This helped my husband and me save a lot of money for their future which is very important. This is especially if we want to support their different passions and goals,” she said.

“Many families are usually sandwiched because of the income criteria and do not qualify for any of the benefits even if they might need them the most. Widening the eligibility shows that the government is keen on helping these people.”

Defraying conservancy charges

The Budget also included additional help for families to cope with the rising costs of living.

A $126 million boost to the Services and Conservancy Charges Rebate looks set to benefit 900,000 HDB households, helping them cope with service and conservancy charges. One and two room flats will receive 3.5 months of rebate, while three and four room flats will receive 2.5 months of rebate.

Five room flats will get 2 months of rebates while those living in executive and multi-generational flats will receive 1.5 months of rebates.

At the same time, the Government will be increasing the GST Voucher U-Save by $20 between 2019 and 2020 to help families offset the rising costs of electricity. Singaporean families can expect to get between $240 and $400 a year, depending on where they stay.

For Madam Chan, who stays in a 4-room HDB flat in Choa Chu Kang with her family, any additional help is welcome.

“It might seem like a small cost because it is handed out every three months. But in the long run, it amounts to quite a sum,” she said.

“We don't have much so every cent counts.”