Singapore’s Fiscal Policy

Singapore’s fiscal policies have helped to steward the country’s progress over the years. They aim to create the conditions for macroeconomic stability, support economic growth, and promote social equity. We achieve this by maintaining a balanced budget, investing for the future, and ensuring a fair and progressive fiscal system.

Our fiscal policies are designed to support the following key objectives:

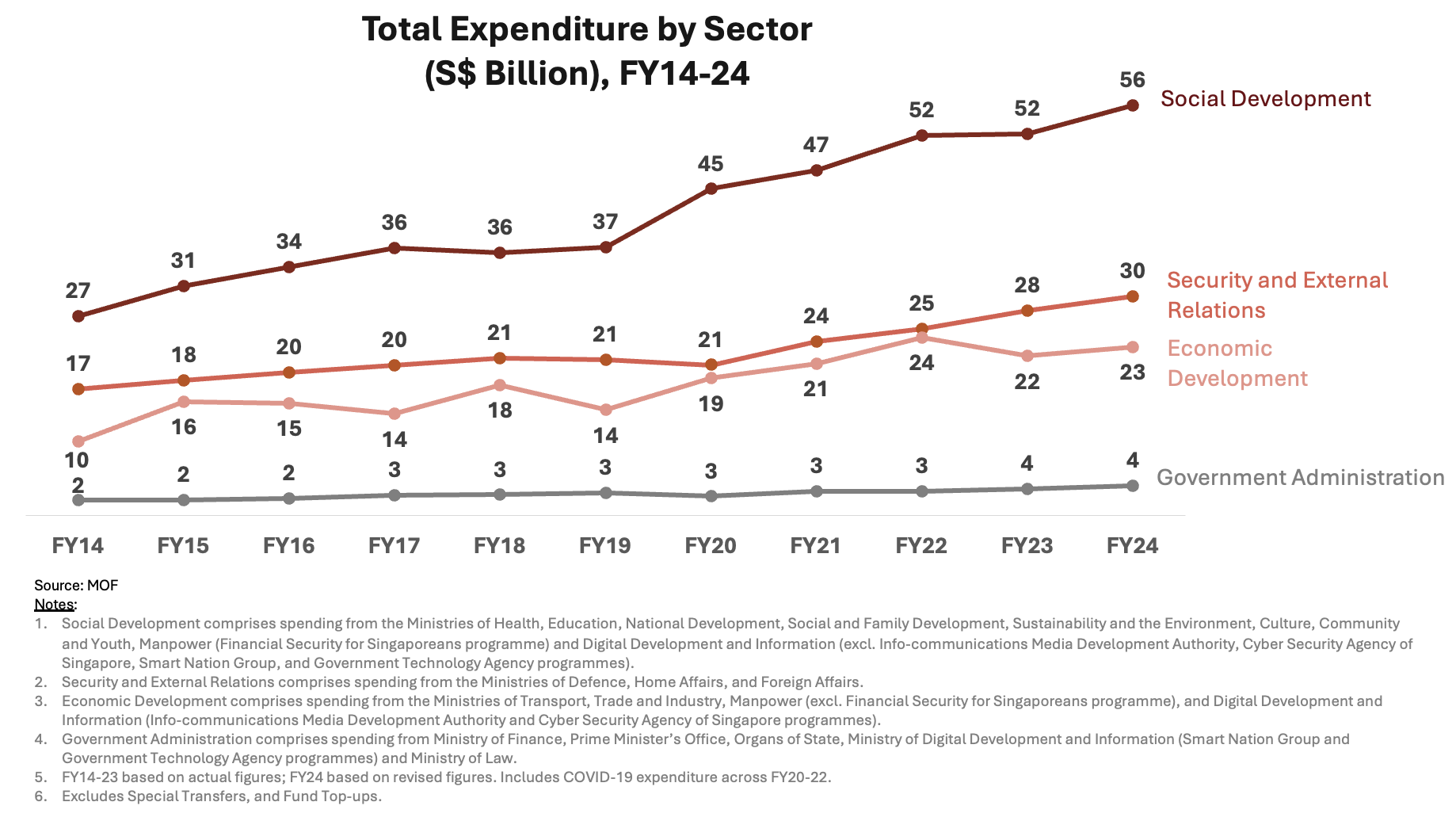

What do we spend on?

Public spending is focused on public goods and infrastructure that enable our people and businesses to thrive and grow. We invest heavily in skills, education and infrastructure to develop our people and lay the foundations for long-term economic growth. We also commit a steady amount of spending on security to safeguard our way of life.As our society ages and we strengthen our safety nets, our social spending has more than doubled over the last decade. Social spending forms the largest part of Budget, taking up about half of total Ministry expenditure. One key spending area is to improve the quality, accessibility and affordability of healthcare.

Planning for the long-term

Fiscal policy in Singapore is characterised by a strong long-term orientation. We plan far ahead to prepare for longer-term challenges such as ageing and climate change. Doing so enables us to intervene effectively upstream, to avoid more costly interventions downstream. It also enables us to help our society and economy adjust to the challenges.We are planning ahead to cater for several new spending priorities going forward, including health and aged care, early childhood education and SkillsFuture, strengthening retirement adequacy, renewing our city infrastructure, managing the green transition, improving our economic competitiveness and protecting ourselves against new security threats.

As part of this longer-term planning, we embarked on the Forward Singapore exercise to refresh our social compact and give more assurance to help Singaporeans navigate the uncertainties in today’s world. We will spend more than $40 billion in total by 2030, supporting Singaporeans through various stages of life. Key moves include the expansion of KidSTART and SkillsFuture, the Majulah Package, Healthier SG and Age Well SG, as well as the enhancement of schemes such as the enhanced Baby Bonus, Workfare, Silver Support and the Matched Retirement Savings Scheme.

Spending for outcomes

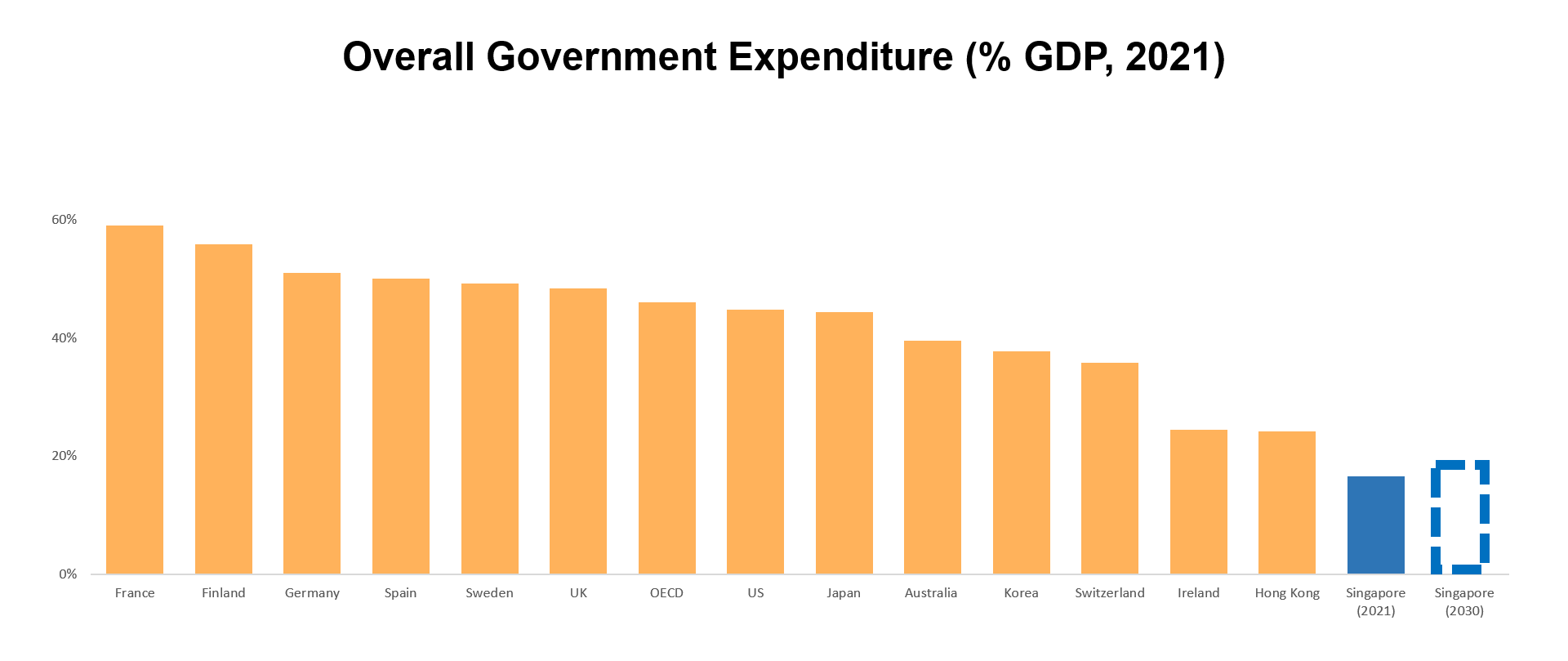

Even as we ensure sufficient public spending to meet the evolving demands of our economy and society, we seek to maintain a light fiscal burden on taxpayers. We seek to achieve strong outcomes while delivering value for money for taxpayers. Today, Singapore's Government expenditure as a share of GDP is among the lowest across advanced economies.

Source: OECD database and MOF

Source: OECD database and MOF

Note: Singapore (2030) assumes the projected upper bound for Government Expenditure

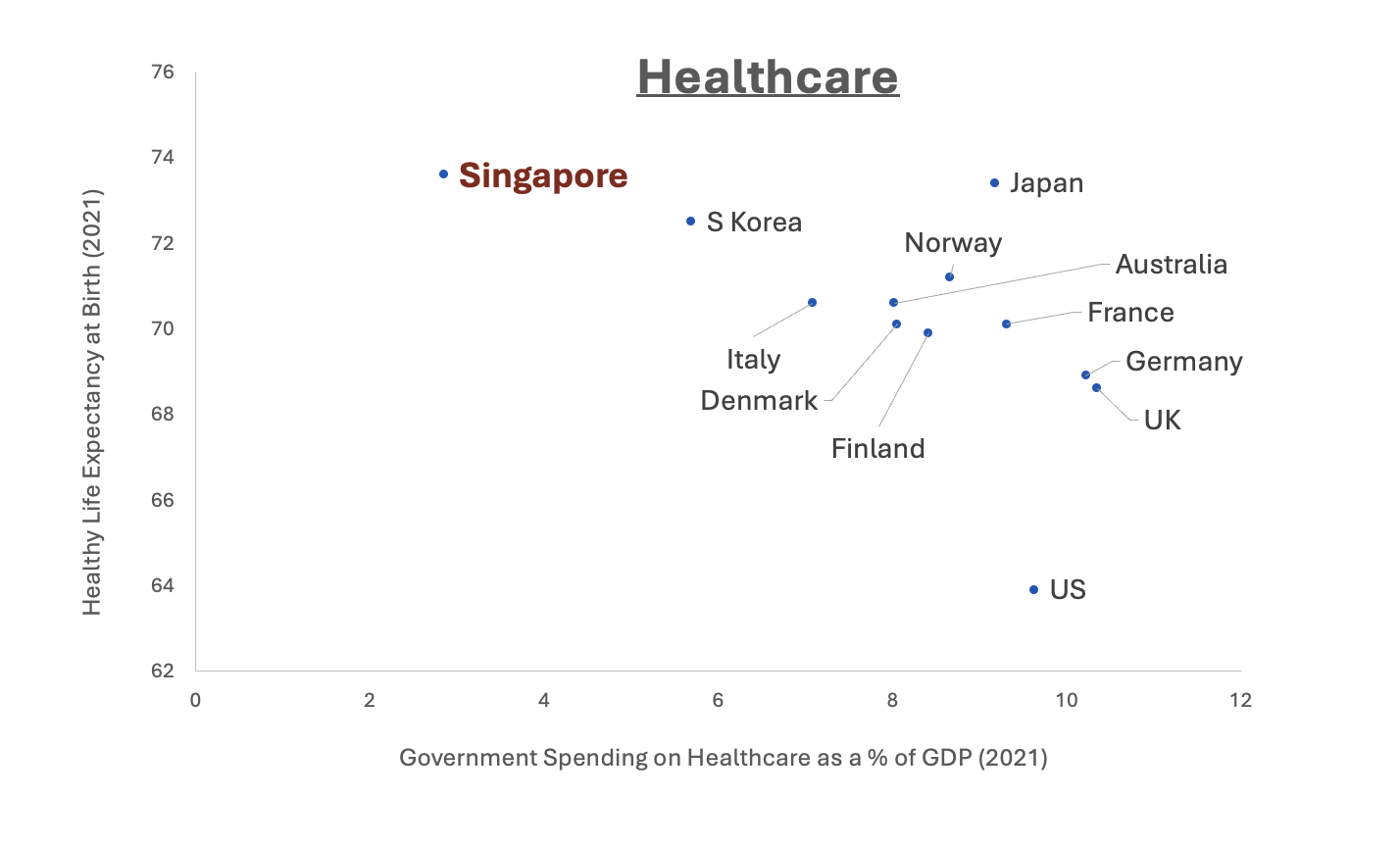

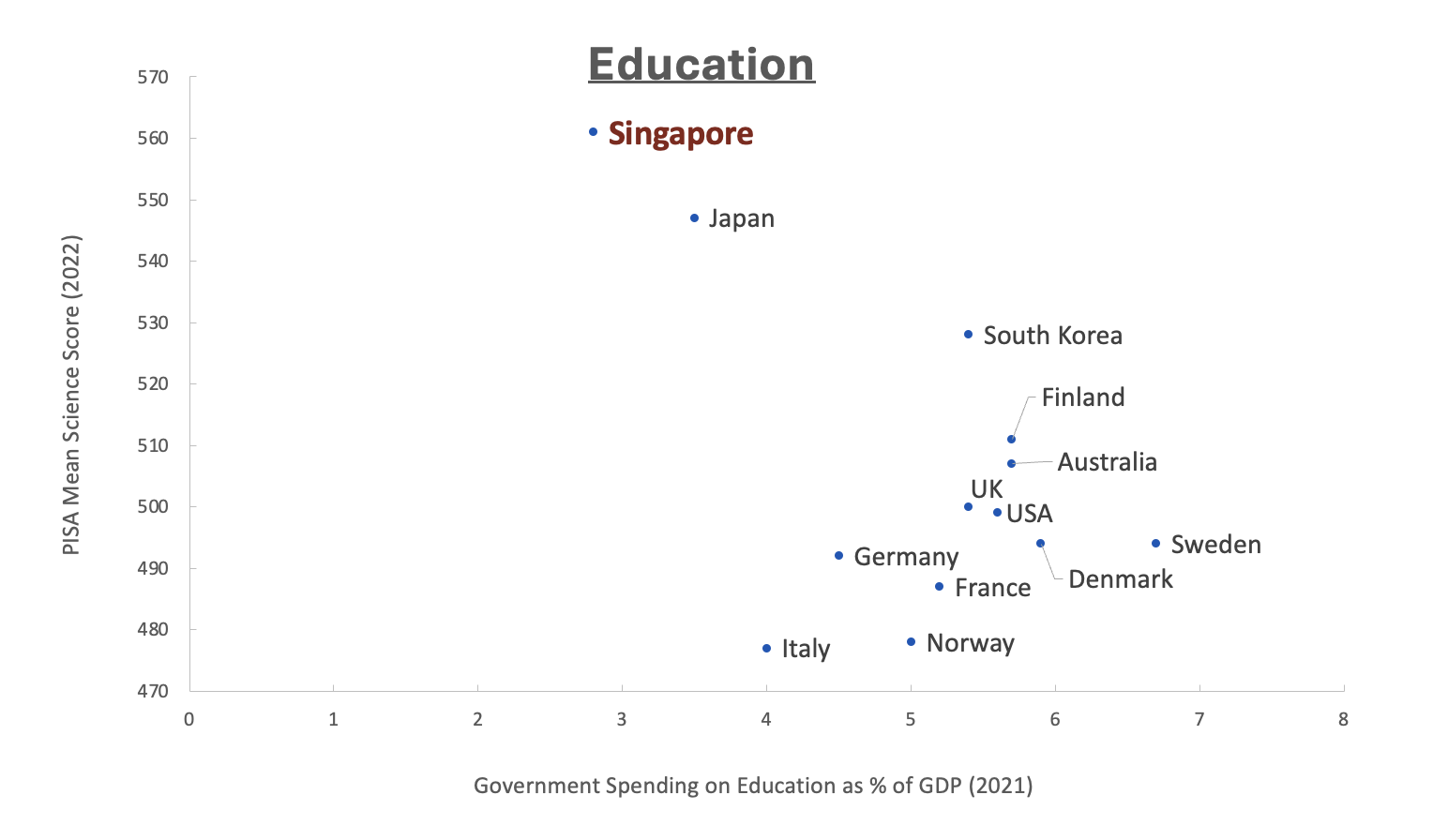

We spend relatively less of our GDP as a Government, and focus on achieving cost-effective spending. In areas such as education, health, policing, we have consistently achieved outcomes near the top internationally (e.g. PISA, healthy life expectancy, Gallup law and order index) despite lower levels of spending as a percentage of GDP than other jurisdictions.

Sources: WHO Global Health Observatory

Sources: WHO Global Health Observatory Sources: OECD, World Bank

Sources: OECD, World Bank

Stewarding our resources for the future

Financial strength helps a small country with no natural resources like Singapore to respond effectively to crises. Over the years, we have been prudent and disciplined in building up our reserves. Our reserves have allowed us to deal with unexpected shocks such as the COVID-19 outbreak and be able to respond decisively by supporting Singaporeans and our workers amidst the pandemic. Unlike many other countries, our reserves have allowed us to do so without borrowing heavily and passing on the financial burden to future generations.

The total draw on reserves is around $40 billion from FY2020 to FY2022, less than the initial sum of $52.0 billion announced at the Fortitude Budget in FY2020. This is in part because of our swift and decisive response to the pandemic, which enabled us to avert worse public health outcomes. It reflects our prudence in the use of reserves.

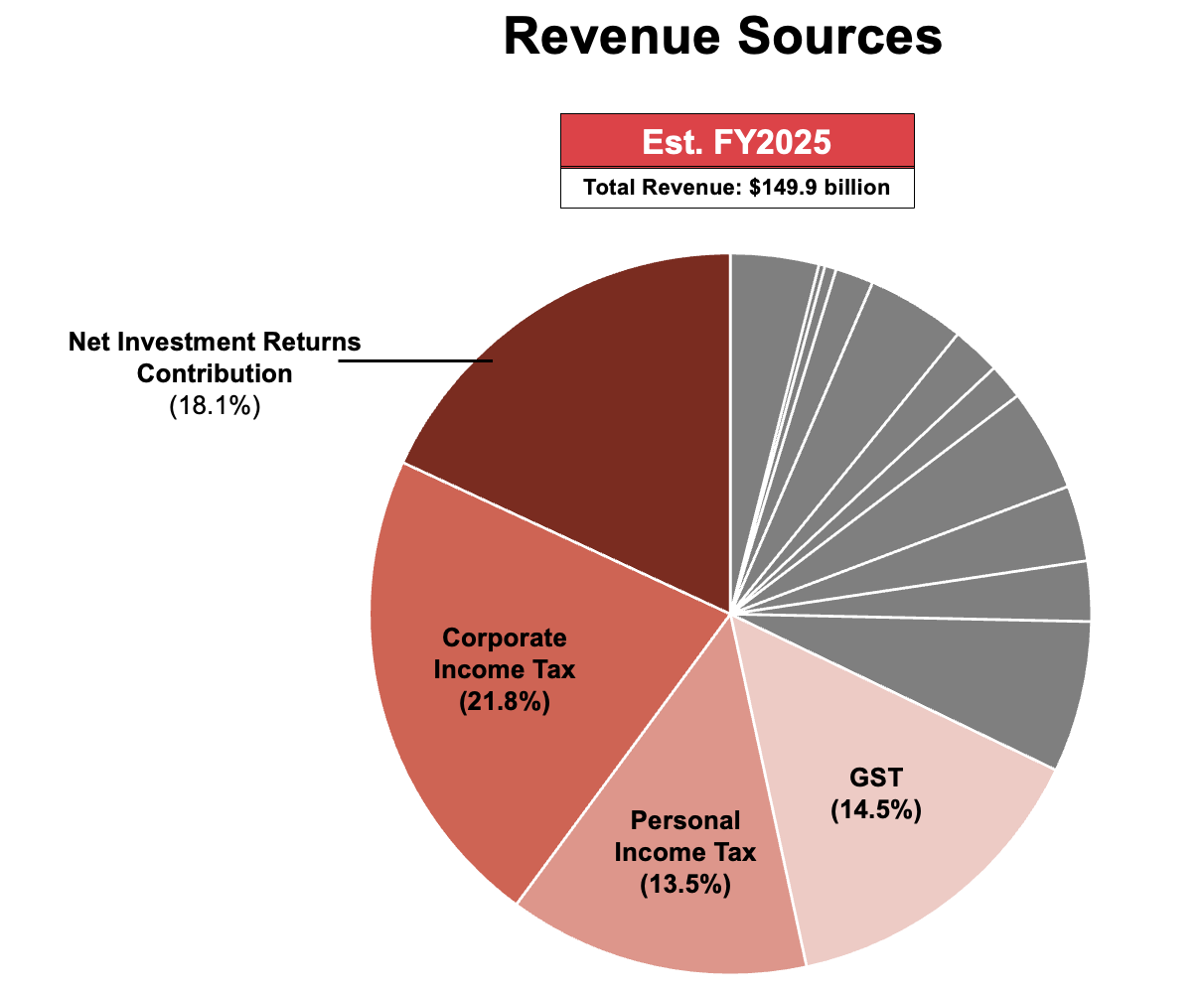

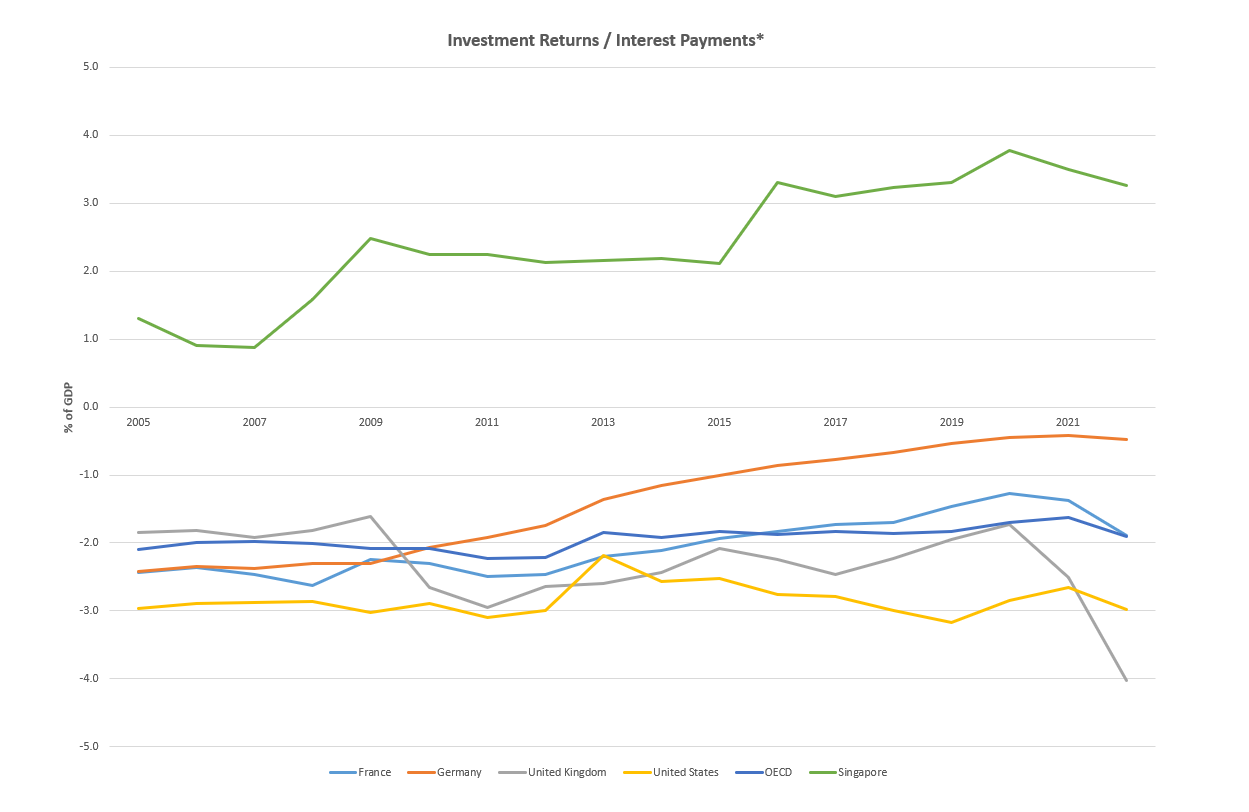

Our reserves also contribute significantly to our total revenues available for annual spending. We invest our reserves for the long-term, and the returns from investing our reserves are shared between present and future generations. Part of the investment returns* supplement our annual budget through the Net Investment Returns Contribution (NIRC). The NIRC forms one of the largest components of Government revenues, contributing about 20% to our annual budget for spending. We have to continue to fiscally plan in a responsible and sustainable manner, to ensure that each generation contributes and benefits fairly from the Budget.

*Investment returns refers to Net Investment Returns Contribution. Interest payments refer to net general government interest payments, retrieved from OECD Economic Outlook 116 database

Building capabilities and delivering inclusive growth

While the share of public spending on development expenditure has declined in many advanced economies, Singapore continues to devote a large part of our budget to development and investment. About 20% of our budget is devoted to development expenditure. This has allowed us to build up the capabilities to secure Singapore’s future growth, and enable our people and firms to grow and compete in a global arena.The Government is investing strongly to accelerate our innovation and digitalisation push, grow our base of innovative enterprises, and pursue new frontiers of growth. We are investing in research areas like health and biomedical sciences, climate change and artificial intelligence. We are forging stronger connections to major innovation nodes and key demand markets, through trade facilitation and digital economy agreements, platforms like the Networked Trade Platform and Global Innovation Alliance, and by continuing to make major investments in our port and airport.

We also invest strongly in our people throughout life, starting from the early years to ensure no one falls behind. This enables our people to take on the new opportunities created and raise our standard of living.

Through our strategies, all Singaporeans have been able to enjoy the fruits of progress. Over the decade from 2014 to 2024, households across all income groups have experienced real income growth, with the lower-income group experiencing higher growth.

Working in partnership

Singapore’s fiscal policy seeks to encourage collective responsibility at all levels of society. It aims to support, enable, and amplify the efforts, ideas and initiatives of the business and people sectors, to build a better Singapore together.Our success in building a vibrant economy, inclusive society and a better home will increasingly hinge on strong partnerships between Government, businesses and community.

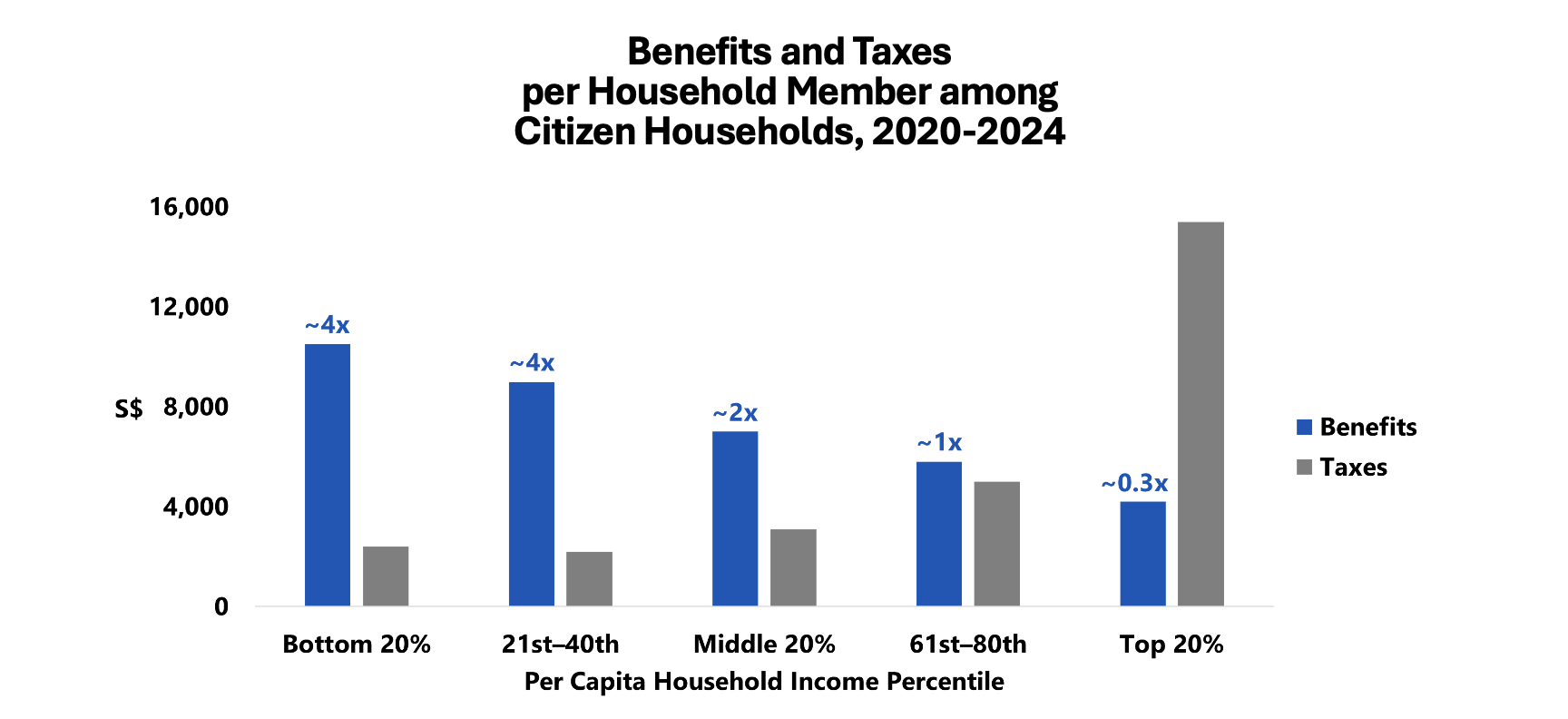

Fair system of taxes and transfers

We are committed to ensure that our overall system of taxes and transfers is progressive – with the better-off contributing more, and lower- and middle-income households receiving more in benefits than the taxes they pay. Today, when you look at the overall balance of taxes and benefits, lower- and middle- income households receive proportionately more benefits from transfers than what they pay in taxes.

Source: MOF estimates

Note: Income groups are based on the ranking of citizen households by household income from employment (including employer CPF contributions) per member. Benefits include transfers, subsidies and capital grants related to housing, employment & training, education, healthcare, social support, childcare, marriage & parenthood, and special transfers. Taxes include personal income tax, GST, vehicle-related taxes, property tax, foreign domestic worker levy, stamp duty, and other indirect taxes.

Fostering social mobility

Our fiscal policy aims to provide a foundation of broad-based opportunities that enables everyone to earn their own success. We redistribute resources in a way that enhances the capability of our people, through investments in areas like education and housing. In these areas, we provide more support for lower- and middle-income groups.In education, we have invested significantly in pre-school and in a high-quality public school system that is accessible to all, so as to equalise opportunities when children are young. Our annual spending on affordable, quality early childhood education has doubled since 2018, and will continue to increase. We have also been allocating extra resources to students from disadvantaged backgrounds and will continue to do so. This includes expanding KidSTART, to help lower-income families and their children in the earliest years, which are critical to their development. We will also continue to take steps to improve preschool affordability through reducing monthly childcare fee caps in Government-supported preschools in 2025 and 2026, and enhancing existing preschool subsidies for lower-income families. Our heavy investment in education also extends into strong tertiary pathways through ITE, polytechnics, universities, and increasingly to lifelong learning.

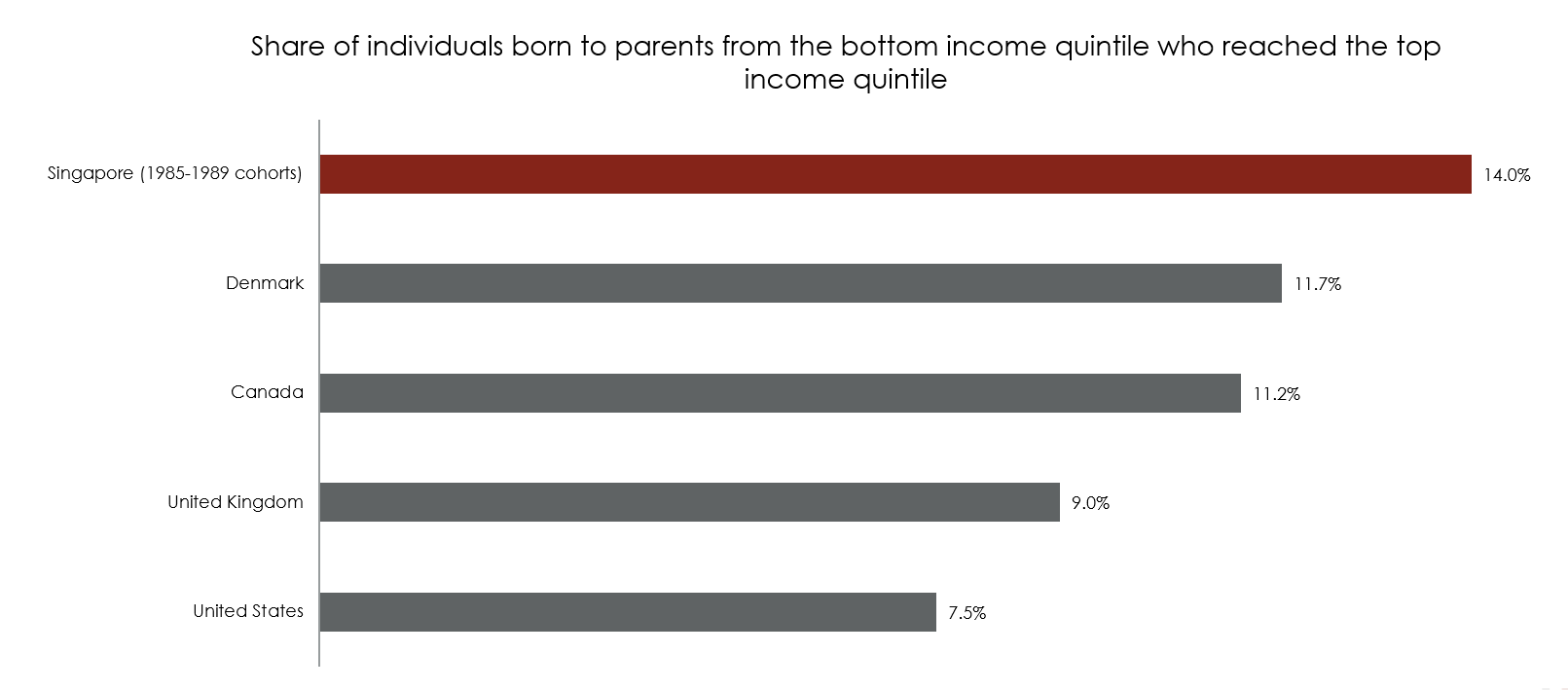

Singaporeans who grew up in lower income families have a better chance of moving up the income ladder than those in other advanced countries. For the 1985-1989 birth cohorts, 14.0% of those born to families from the lowest 20% by household income made it to the highest 20% by income.

Source: MOF — Singapore; Chetty et al. (2014) — United States, United Kingdom, Denmark; Connolly et al. (2019) — Canada

Analysis of Revenue and Expenditure ( 704 KB)

Revenue and Expenditure Estimates ( 7,253 KB)

View and download individual Revenue and Expenditure Estimates or complete set in here (23,128 KB).

OVERALL FISCAL POSITION IN FY2025

| Revised FY2024 | Estimated FY2025 | Change Over Revised FY2024 | ||

| $billion | $billion | $billion | %change | |

| OPERATING REVENUE | 116.62 | 122.78 | 6.16 | 5.3 |

| Corporate Income Tax | 30.88 | 32.67 | 1.79 | 5.8 |

| Personal Income Tax | 18.96 | 20.23 | 1.27 | 6.7 |

| Withholding Tax | 2.28 | 2.40 | 0.12 | 5.1 |

| Statutory Boards' Contributions | 0.64 | 0.41 | (0.23) | (36.5) |

| Assets Taxes | 6.70 | 6.89 | 0.19 | 2.9 |

| Customs, Excise and Carbon Taxes | 3.45 | 4.04 | 0.59 | 17.1 |

| Goods and Services Tax | 20.61 | 21.73 | 1.12 | 5.5 |

| Motor Vehicle Taxes | 2.51 | 2.57 | 0.05 | 2.1 |

| Vehicle Quota Premiums | 6.54 | 6.60 | 0.06 | 0.9 |

| Betting Taxes | 3.23 | 3.29 | 0.06 | 2.0 |

| Stamp Duty | 6.36 | 5.92 | (0.44) | (6.9) |

| Other Taxes1 | 9.12 | 10.17 | 1.05 | 11.5 |

| Fees and Charges (Excluding Vehicle Quota Premiums) | 4.58 | 5.08 | 0.50 | 10.8 |

| Others | 0.75 | 0.77 | 0.02 | 2.5 |

| Less: | ||||

| TOTAL EXPENDITURE | 112.91 | 123.79 | 10.88 | 9.6 |

| Operating Expenditure | 89.55 | 97.03 | 7.48 | 8.3 |

| Development Expenditure | 23.36 | 26.76 | 3.40 | 14.6 |

| PRIMARY SURPLUS / DEFICIT | 3.71 | (1.01) | ||

| Less: | ||||

| SPECIAL TRANSFERS1 | 25.12 | 23.38 | (1.74) | (6.9) |

| Special Transfers Excluding Top-ups to Endowment and Trust Funds | 3.07 | 3.78 | ||

| SG60 Vouchers | – | 2.02 | ||

| CDC Vouchers | 0.78 | 1.06 | ||

| Other Transfers3 | 2.29 | 0.69 | ||

| BASIC SURPLUS / DEFICIT | 0.64 | (4.79) | ||

| Top-ups to Endowment and Trust Funds | 22.05 | 19.60 | ||

| Changi Airport Development Fund | – | 5.00 | ||

| Coastal and Flood Protection Fund | – | 5.00 | . | |

| Future Energy Fund | 5.00 | 5.00 | ||

| National Productivity Fund | 2.00 | 3.00 | ||

| National Research Fund | 1.80 | 1.50 | ||

| Other Funds4 | 13.25 | 0.10 | ||

| Add: | ||||

| NET INVESTMENT RETURNS CONTRIBUTION | 24.02 | 27.14 | 3.11 | 12.9 |

| OVERALL BUDGET SURPLUS / DEFICIT | 2.62 | 2.74 | ||

| Add: | ||||

| CAPITALISATION OF NATIONALLY SIGNIFICANT INFRASTRUCTURE | 4.17 | 4.63 | 0.46 | 11.0 |

| Less: | ||||

| DEPRECIATION OF NATIONALLY SIGNIFICANT INFRASTRUCTURE | – | – | – | n.a. |

| SINGA INTEREST COSTS AND LOAN EXPENSES2 | 0.38 | 0.56 | 0.19 | 49.3 |

| OVERALL FISCAL POSITION | 6.41 | 6.81 | ||

Footnotes

Note: Due to rounding, figures may not add up. Negative figures are shown in parentheses.

- Special Transfers include Top-ups to Endowment and Trust Funds.

- SINGA Interest Costs and Loan Expenses include the annual effective interest costs (which is computed based on the yield to maturity multiplied by the face value of the bond) and other ancillary loan expenses incurred in connection with the SINGA. It excludes principal repayment and transfer of loan discount to Development Fund. It is different from the Debt Servicing and Related Costs presented in the Expenditure Estimates and Annex to Expenditure Estimates for Head Y.