Budget 2022

Deputy Prime Minister (DPM) and Minister for Finance Lawrence Wong delivered the Singapore Government’s Budget Statement for Financial Year 2022 in Parliament on 18 February 2022. The Charting Our New Way Forward Together Budget presented the Government’s plans in renewing and strengthening Singapore’s social compact for a post-pandemic world, and realising our vision of a fairer, more sustainable, and more inclusive society.

In this section, you can find out more about Budget 2022.

- Charting Our New Way Forward Together Budget - (Statement

639 KB, Annexes 1,941 KB), (Round-up Speech

639 KB, Annexes 1,941 KB), (Round-up Speech  1,690 KB)

1,690 KB) - Analysis of Revenue and Expenditure (

793 KB)

793 KB) - Revenue and Expenditure Estimates (

7,195 KB)

7,195 KB)

Budget Booklet

-

Charting Our New Way Forward Together Budget 2022 Booklet – (English

11,659 KB | Chinese

11,659 KB | Chinese

14,792 KB | Malay

14,792 KB | Malay

11,434 KB | Tamil

11,434 KB | Tamil

15,982 KB)

15,982 KB)

Budget Summaries & Infographics

-

Charting Our New Way Forward Together Budget 2022 One-Page Overview (

247 KB)

247 KB)

-

Charting Our New Way Forward Together Budget 2022 Summary Infographic (English

1,896 KB | Chinese

1,896 KB | Chinese

2,327 KB | Malay

2,327 KB | Malay

2,306 KB | Tamil

2,306 KB | Tamil

2,373 KB)

2,373 KB)

For Families and Individuals

For Businesses and Workers

-

Support for Businesses (English

1,218 KB | Chinese

1,218 KB | Chinese

1,433 KB | Malay

1,433 KB | Malay

1,418 KB | Tamil

1,418 KB | Tamil

1,484 KB)

1,484 KB)

-

Support for Workers (English

2,882 KB | Chinese

2,882 KB | Chinese

2,913 KB | Malay

2,913 KB | Malay

2,887 KB | Tamil

2,887 KB | Tamil

2,954 KB)

2,954 KB)

Our Taxes and Transfer System

-

Our Progressive System of Taxes and Benefits (

1,024 KB)

1,024 KB)

-

A Fairer and More Resilient Tax System (English

908 KB | Chinese

908 KB | Chinese

1,835 KB | Malay

1,835 KB | Malay

1,803 KB | Tamil

1,803 KB | Tamil

1,860 KB)

1,860 KB)

Green Initiatives

Watch DPM Wong deliver the Budget 2022 statement, as well as videos on key Budget 2022 measures on MOFSpore’s Budget 2022 YouTube playlist.

Budget Explainers

Moving Forward with Budget 2022: Our Revenue Options

• Budget 2022 represents a first and critical step in renewing and strengthening our social compact for a post-pandemic world, and in realising our vision of a fairer, more sustainable, and more inclusive society.

• Like

other jurisdictions, including those in the Organisation for Economic Co-operation and Development (OECD), we tax all three bases – income, assets and consumption. This ensures that we have a diversified and resilient tax revenue system where

everyone contributes to taxes and nation building.

• We keep our overall tax burden low. Income tax rates (both personal and corporate) are higher in the OECD than in Singapore. The OECD jurisdictions also have much higher double-digit

VAT rates (the equivalent of our GST).

• More importantly, we have a fair and progressive system of taxes and transfers. We levy higher taxes on those who are better off, and provide more support for those who are less

well off. As a result, the better off contribute much more in taxes than the benefits they receive, while the low- and middle-income receive more in benefits than the taxes they pay.

Our Fiscal Challenge

• Government spending rose from 15% of GDP a decade ago to 18% now and is expected to rise to 20% of GDP or more by 2030. This increase is necessary and unavoidable, as our population rapidly ages. We will need to spend more to take better

care of a larger number of seniors.

• Healthcare spending alone will rise from $11.3b today to about $27b by 2030. That is a huge funding gap that needs to be closed.

• The Government studied all options to address the funding gap and decided on a three-pronged approach.

1. GST rate increase

• This yields $3.5b in revenue every year - but will not be enough to cover the increase in healthcare spending.

• We implement GST in our uniquely Singaporean way:

With the GSTV and absorption of GST on publicly subsidised education and healthcare, most Singaporean households pay much less than today’s 7% GST rate.

| GST + the permanent GST Voucher (GSTV) + Government absorbing GST on publicly-subsidised education and healthcare. |

• When the GST rate goes up to 8% in January 2023 and 9% in January 2024, the bottom 30% of Singaporean households will not be impacted, because the increase in GST rate will be offset by the enhanced GSTV scheme for these households.

You can also read more here.

• From the year of assessment 2024, the top marginal personal income tax (PIT) rate will be raised from 22% to 24%.

• The increase in marginal PIT rates affects the top 1.2% among those who pay PIT, with chargeable income of $500,000 and more. They will pay an additional $170 million in tax every year.

• At 24%, we are already higher than Hong Kong’s top marginal PIT rate of 17% and closer to the average top marginal PIT rate in Asia of 28%.

• There is a limit to how much more we can raise personal income tax revenue by further increasing the top marginal PIT rate. For instance, to raise the same amount of revenue of $3.5b as the GST rate increase, we will need to raise the top marginal PIT rate from 22% to 42% for chargeable income in excess of $320,000. This assumes the tax base remains unchanged, i.e. people do not relocate. But that is not realistic. Such a sharp increase in PIT is untenable and will badly damage our competitiveness.

• In reality, to raise the same amount as a GST increase through higher PIT, we would end up having to raise the PIT rates for a broader group of income earners, including upper-middle-income and even middle-income earners.

• The Government has been raising wealth taxes for residential properties and cars over time – in Budget 2010, Budget 2013, Budget 2018 and now Budget 2022.

• We have kept our Budget 2022 property tax increase significant but targeted. We will collect additional property tax of $380m per year from all non-owner-occupied residential properties, and the top 7% of all owner-occupied residential properties. The changes do not impact all owner-occupied HDB flats and 2 in 3 owner-occupied private residential properties.

• To make the vehicle tax system more progressive, we introduced another Additional Registration Fee tier in Budget 2022 for luxury cars at a rate of 220%. This applies to the portion of Open Market Value in excess of $80,000.

• The Government continues to study all options to tax wealth effectively. But there are challenges to doing so:

o Some have suggested introducing a new net wealth tax.

o Many forms of wealth are mobile, and as long as there are differences in wealth taxes across jurisdictions, such wealth can and will move.

o This is why many jurisdictions have abolished their net wealth taxes. Only 3 OECD jurisdictions now have a net wealth tax.

o Furthermore, the middle- and upper-middle-income individuals may be disproportionately affected compared to the rich who can find ways to avoid paying net wealth taxes through tax planning.

o We welcome ongoing feedback on how to make a suggested net wealth tax work in practice in Singapore’s context, when almost all our competitors in this region and worldwide do not levy such a tax.

• Various alternatives to the revenue measures in the Budget have been raised. But they will not provide viable solutions to close our funding gap.

1. Corporate Tax

• There are ongoing discussions among governments worldwide to redesign the international rules for corporate taxation, through an initiative called the Base Erosion and Profit Shifting or BEPS 2.0. There are two Pillars in BEPS 2.0.

• Pillar 1 seeks to re-allocate profits and taxes from where the economic activities are conducted to where the markets or the customers are. Singapore will lose tax revenue under Pillar 1 as we have a significant extent of economic activities conducted here but a small domestic market.

• Pillar 2 seeks to introduce a minimum effective tax rate of 15% at the group level for MNEs in every jurisdiction the MNE operates. In response, we are studying the possible implementation of a Minimum Effective Tax Rate or METR regime, which will top up the MNE group’s effective tax rate in Singapore to 15%.

• METR will raise more taxes if our tax base remains unchanged. But this is a big “if”, as the eventual impact of Pillar 2 on our total tax revenue will depend on how governments and companies respond. Companies will review their existing and new investment. Other governments will also seek to compete via non-tax means to make up for what they can no longer do so through tax incentives.

• Therefore, at this stage, it is premature and difficult to determine the eventual fiscal impact of the two pillars of BEPS 2.0.

• Furthermore, we must expect global competition for investments to intensify in a post-pandemic future. Even if we can generate additional corporate tax revenue from BEPS 2.0, the revenues will have to be reinvested into enhancing our overall competitiveness, so that we can continue to attract our fair share of investments and create good jobs for all Singaporeans.

• Some have suggested taxing externalities, like carbon, alcohol, or tobacco consumption.

• But the increase in carbon tax, as announced in Budget 2022, is not expected to generate additional revenue. We expect to channel the carbon tax revenue to support a decisive shift towards decarbonisation through investments in new low-carbon and more energy efficient solutions. These investments will help to lower our emissions and bring us closer towards our net zero goal. Some of the revenue will also be used to cushion the impact on households and businesses.

• We levy duties on alcohol and tobacco to deter consumption, and not for purposes of generating revenue. We continually review and adjust these taxes from time to time.

• The current rules on the reserves already give us a regular stream of income for our recurrent spending through the Net Investment Returns Contribution (NIRC). Land sales proceeds are not directly spent, but are instead invested as part of our reserves, and its returns form part of the NIRC as reflected in the Budget Statement. The NIRC has provided revenues averaging 3.5% of GDP annually (or $17b per year) over the past five years. This has enabled us to run balanced budgets even as our needs grow. Going forward, we expect the NIRC stream to continue to keep pace with economic growth.

• Some have proposed changing the reserves rules (e.g. adjusting the NIRC parameters or using more of land sales) in order to increase our revenue. But that means using more from the reserves today and leaving less behind for future generations. This will translate to a heavier tax burden for our children and the next generation of Singaporeans.

• Imagine if we were to have 20% less NIRC than today’s levels (e.g. because our predecessors had chosen to spend more from the reserves years ago), our GST would now need to increase to 11% instead of 9%.

• We are thankful that our forefathers did not take the easy way out. Instead, they were disciplined and considered our needs. Likewise, we should keep faith with future generations and ensure that they too will always have access to sufficient resources to meet any emergencies, as well as a steady stream of income for their future needs.

• The package of revenue measures in Budget 2022 is the result of careful consideration and feedback from many stakeholders. We analysed different combinations of revenue moves to ensure that our decisions will enable us to meet our revenue needs while keeping our economy competitive and taking good care of the low-income and our seniors.

• Ultimately, Budget 2022 is about collective needs and collective responsibility. Everyone contributes in taxes towards the cost of the Government delivering services, and everyone benefits from these services. Those with greater means contribute more and benefit less; while those with fewer means contribute less and receive more benefits.

• This is a fair and inclusive fiscal system to underpin our social compact and to take care of all Singaporeans, now and in the future.

Moving Forward with Budget 2022: GST and What It Means for Everyone

A. Why do we need to raise the GST?

1. Raising GST is part of a suite of revenue moves (alongside changes to personal income tax, property tax, and vehicle tax) announced during Budget 2022 to support our higher spending needs,

especially for healthcare.

2. A broad-based tax like the GST makes a direct link between our demands as voters, and our responsibilities as citizens. It reinforces the principle of collective responsibility, where everyone contributes,

and everyone benefits. But we apply this principle to different degrees for different groups of taxpayers:

a. Those with greater means bear a higher tax burden, and receive less benefits from the government.

b. Those with fewer means bear a lower tax burden, and draw more benefits.

3. In this way, we all do our part to help ourselves and one another. We strengthen our social compact, and the trust that binds us together as a society.

B. How do we ensure the lower-income households are not adversely affected now, and in the future?

4. We cushion the impact of the GST in two ways.

a. First, the enhanced Assurance Package will ease the transition for all Singaporeans, with significant payouts over the next five years. Lower-income households and seniors will receive more.

b. Second, the permanent GST Voucher scheme

has been enhanced and will provide continuing offsets for the GST expenses of lower- to middle-income households, and most retiree households, beyond the transitional period.

c. Both will be implemented together, before the GST increase

takes effect.

5. Our way of implementing the GST, together with the permanent GSTV scheme, does not hurt the poor.

a. For the bottom 10% of Singaporean households, including many retiree households, they do not pay any GST, after offsets.

b. When the GST rate goes up to 9%, the effective rate for Singaporean households in the bottom three deciles

will see no increase. For low-income households, the enhanced permanent GST Voucher neutralises the impact of the increase in GST.

C. Who bears a greater share of the burden of the GST increase?

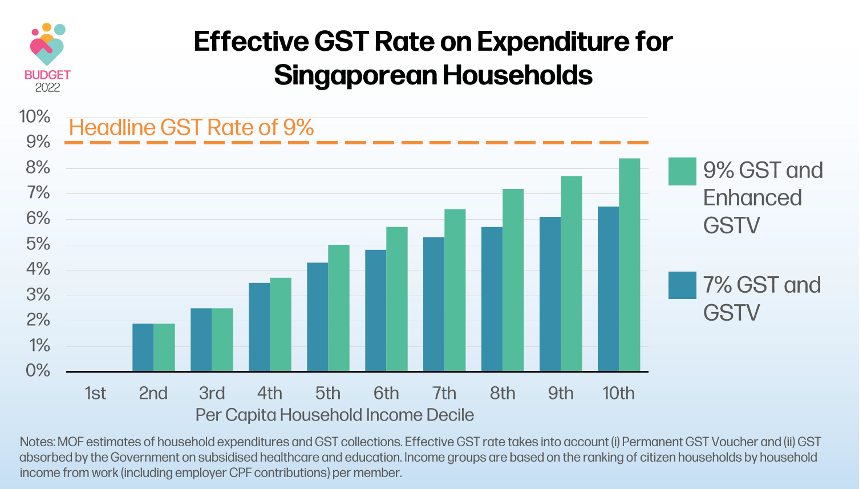

a. The changes in the effective GST rates across different income deciles reveal how the burden of the GST increase is distributed across the various income groups.

b. As seen from the chart, the low-income groups (bottom three

deciles) are not impacted.

c. The middle-income groups will face some increases in their GST payable. But they continue to pay an effective GST rate which is well below the headline 9% rate, because they too will benefit from

the permanent GSTV.

d. After the GST increase, it is the top 20% of citizen households who will pay a greater share of the GST paid by Singaporean households.

e. It is also important to recognise that the GST burden

is not just borne by Singaporean households. A significant part of the GST is paid by foreigners living in Singapore, tourists, companies, and public sector agencies.

D. Why not exempt essential items from GST?

6. Doing so will add to administrative costs, and significantly complicate the GST system. But the bigger problem with such exemptions is that they do not effectively

target support to those with greater needs. With these exemptions, we will end up benefitting the well-to-do more, as they spend more on everything, not just luxury items, but basic necessities as well. Studies done by other governments and organisations

like the OECD have reached similar conclusions.

7. Through the permanent GST Voucher scheme, we achieve better outcomes than the alternative of exempting basic necessities from GST. Essentially, our GST system is tiered by the

impact of our GST – the well-to-do pay more GST, and the lower-income are impacted the least. This is a fairer and more effective way to tax consumption and to ensure that assistance is properly targeted at the lower income.