Support Go Where

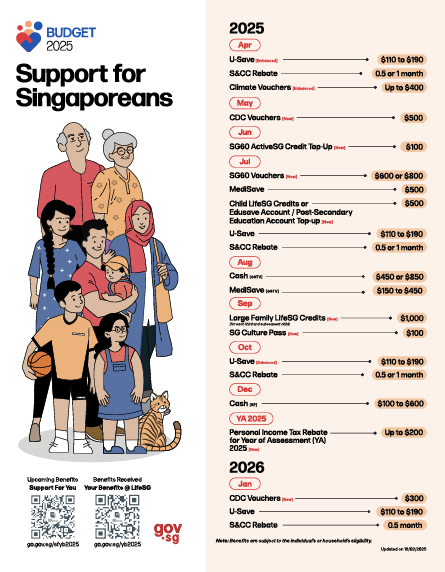

View the measures announced at Budget 2025 and find out the estimated benefits for you and your household.

Benefits for You

SG60 Vouchers

- For all Singaporeans aged 21 to 59: $600

- For all Singaporeans aged 60 and above: $800

Cash

- For all Singaporeans aged 21 and above

- Assurance Package: $100 to $600

- GST Voucher scheme for lower- and middle-income Singaporeans: $450 or $850

MediSave

- For Singaporeans aged 65 and above: $150 to $450

- Additional MediSave Bonus for Singaporeans born in 1950 to 1973 with lower MediSave balances: $500

Large Family LifeSG Credits

- For each third and subsequent child, in the years the child turns 1 to 6: $1,000

Child LifeSG Credits or Edusave Account / Post-Secondary Education Account (PSEA) Top-up

- Child LifeSG Credits for all Singaporean children aged 12 and below: $500

- Edusave Account / PSEA top-up for all Singaporean children aged 13 to 20: $500

SG60 ActiveSG Credit Top-Up

- For all ActiveSG members: $100

SG Culture Pass

- For all Singaporeans aged 18 and above: $100

Personal Income Tax Rebate

- For all tax residents, 60% of tax payable for Year of Assessment 2025: Up to $200

Benefits for Households

CDC Vouchers

- For all Singaporean households: $800

U-Save

- For HDB households: $440 to $760

S&CC Rebate

- For HDB households: 1.5 to 3.5 months offset

Climate Vouchers

- For all HDB households: $400 (including $100 top-up)

- For all Singaporean private property households: $400

Note: Benefits are subject to the individual’s or household’s eligibility. Government officials will NEVER ask you to transfer money or disclose banking details over a phone call. Call the 24/7 ScamShield Helpline at 1799 if you are unsure if something is a scam.