Budget 2025 on GoBusiness

Check out the Budget Navigator for Businesses on the GoBusiness portal

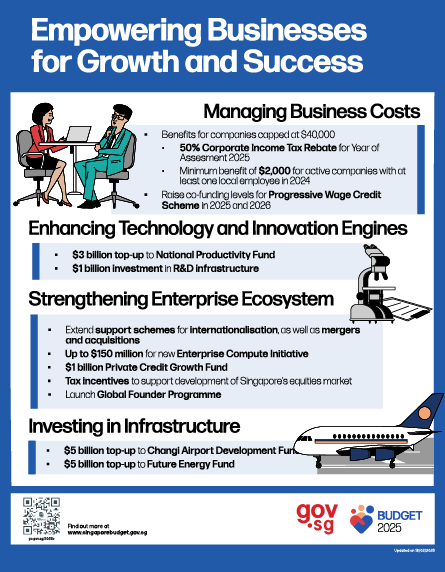

Managing Business Costs

- Benefits for companies capped at $40,000

- 50% Corporate Income Tax Rebate for Year of Assessment 2025

- Minimum benefit of $2,000 for active companies with at least one local employee in 2024

- Raise co-funding levels for Progressive Wage Credit Scheme in 2025 and 2026

Enhancing Technology and Innovation Engines

- $3 billion top-up to National Productivity Fund

- $1 billion investment in R&D infrastructure

Strengthening Enterprise Ecosystem

- Extend support schemes for internationalisation, as well as mergers and acquisitions

- Up to $150 million for new Enterprise Compute Initiative

- $1 billion Private Credit Growth Fund

- Tax incentives to support development of Singapore’s equities market

- Launch Global Founder Programme

Investing in Infrastructure

- $5 billion top-up to Changi Airport Development Fund

- $5 billion top-up to Future Energy Fund